Managing your portfolio

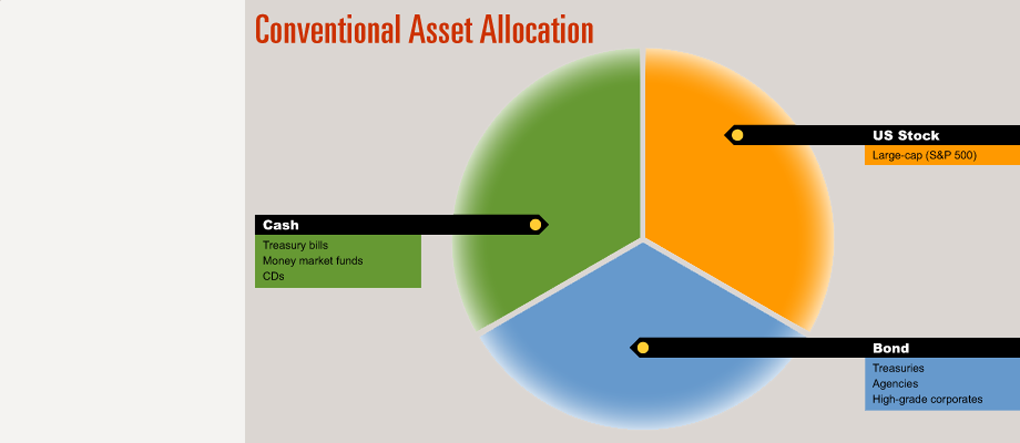

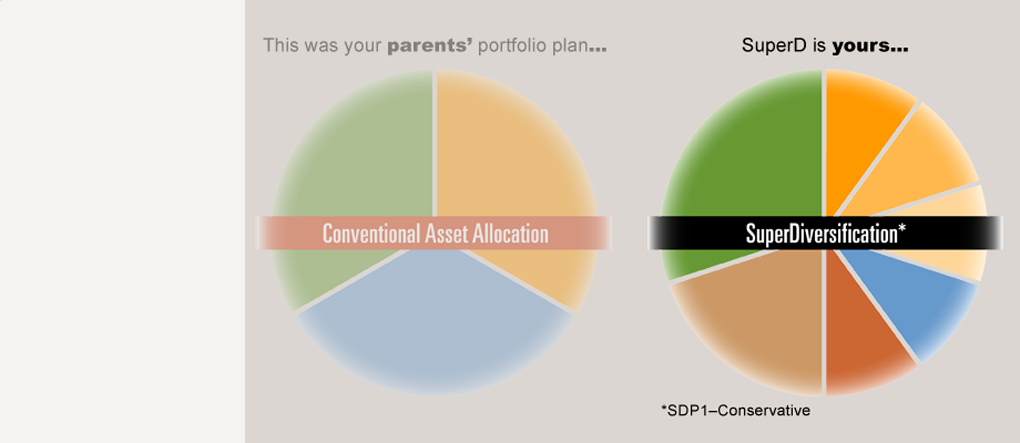

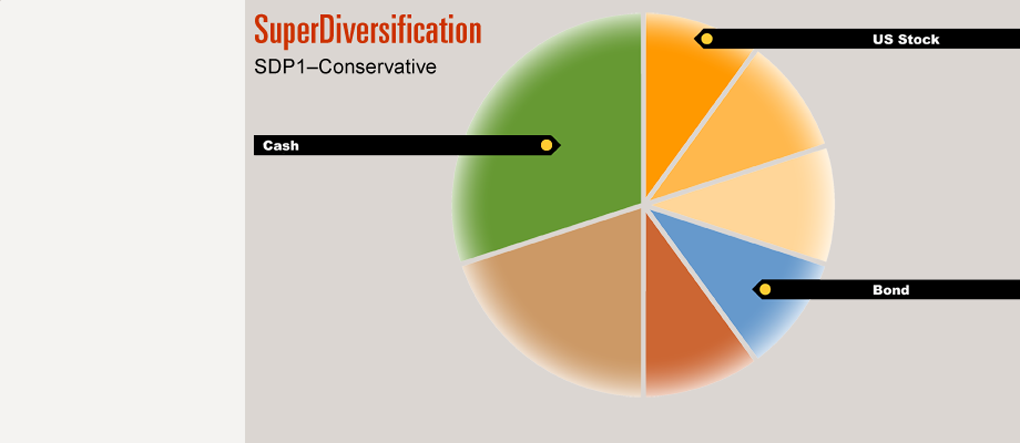

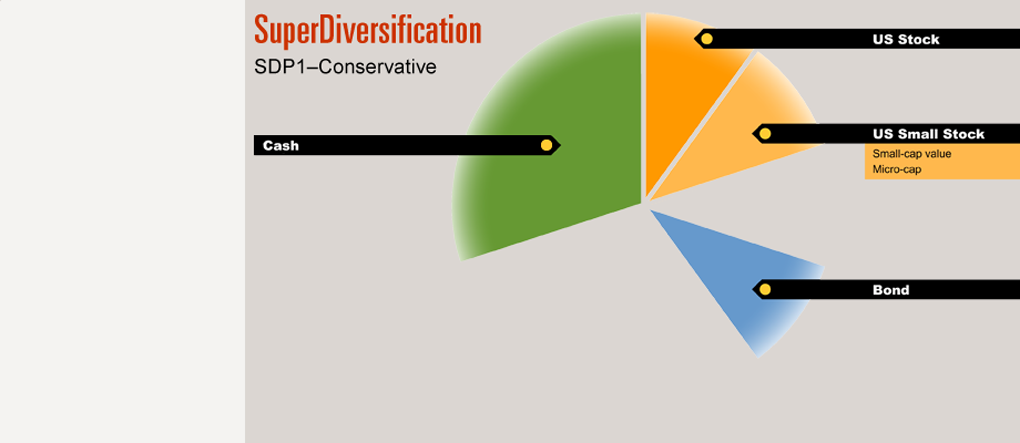

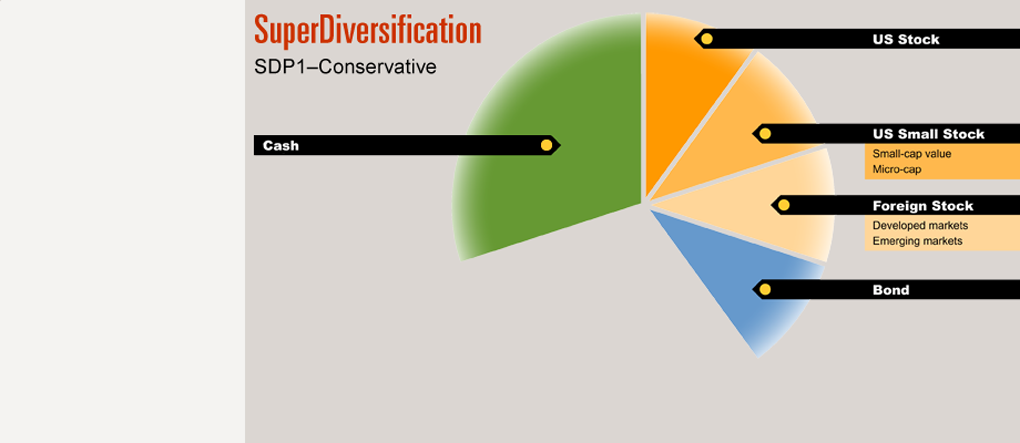

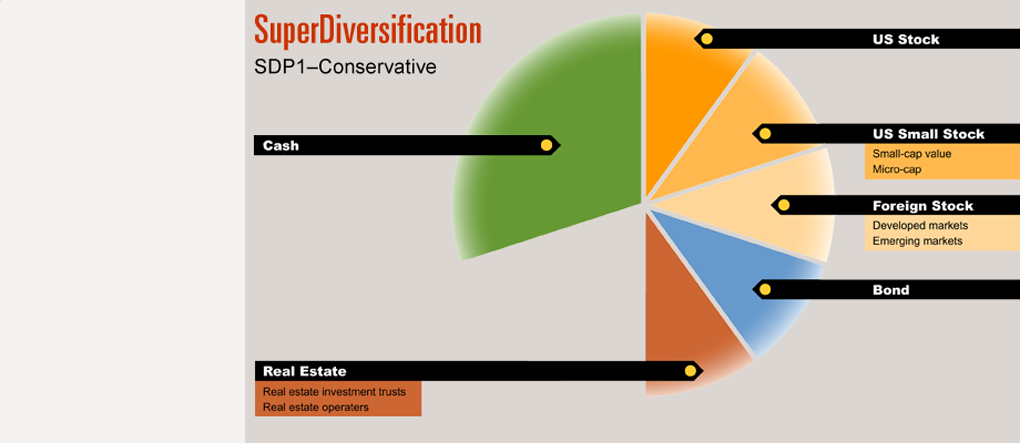

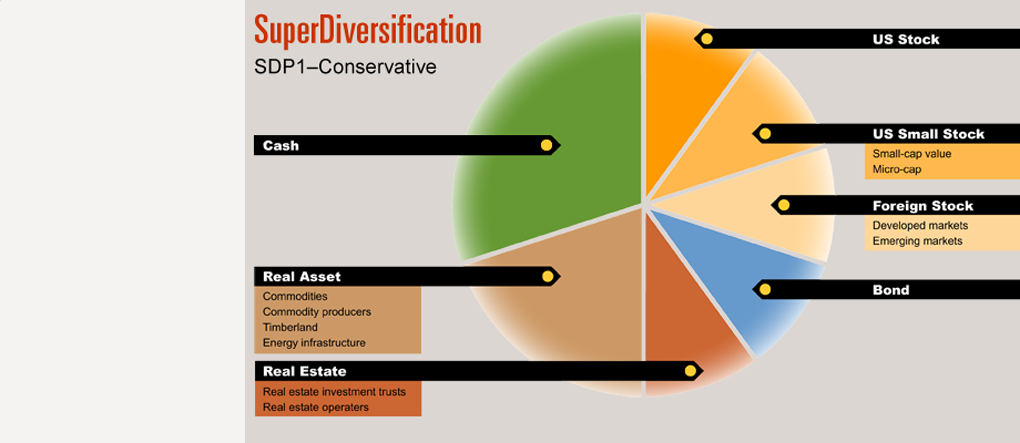

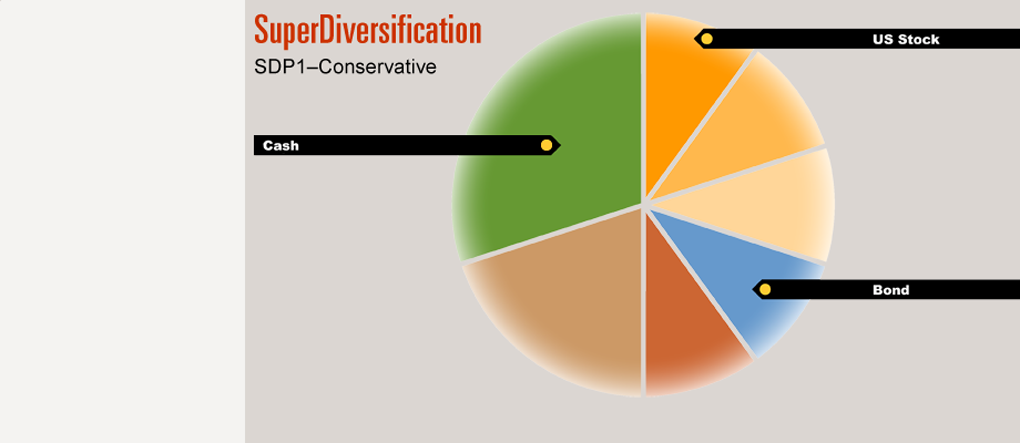

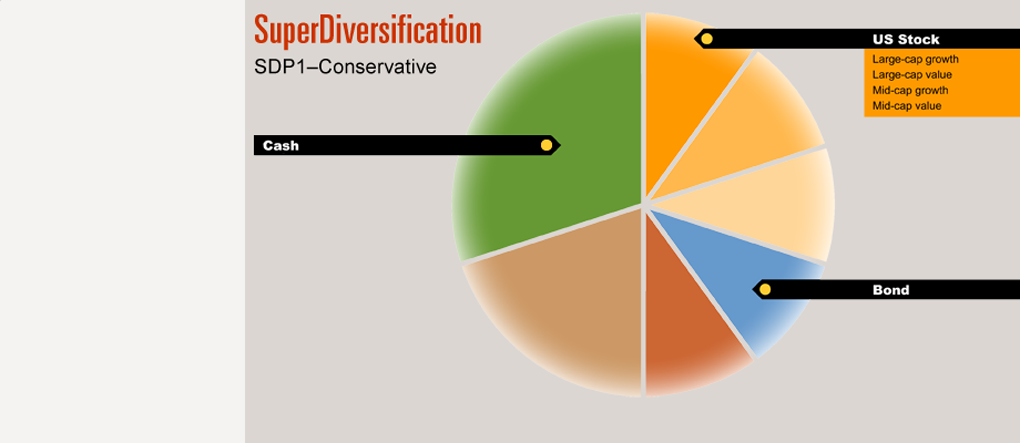

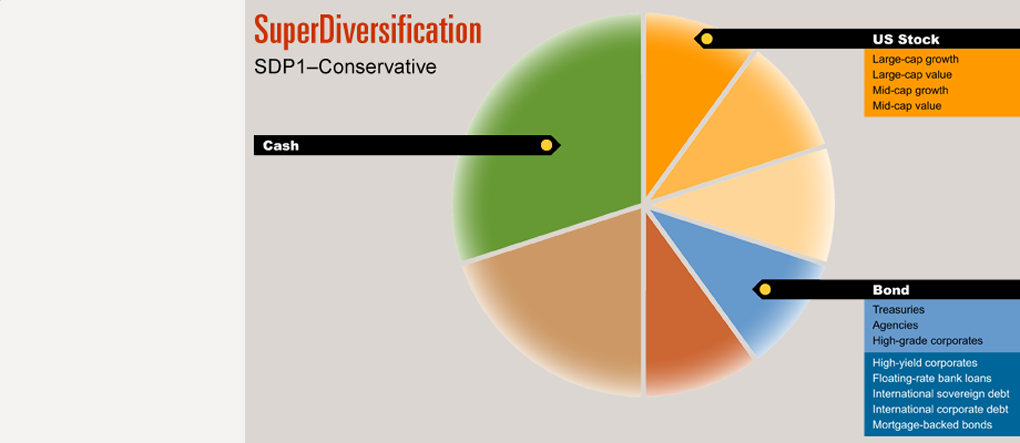

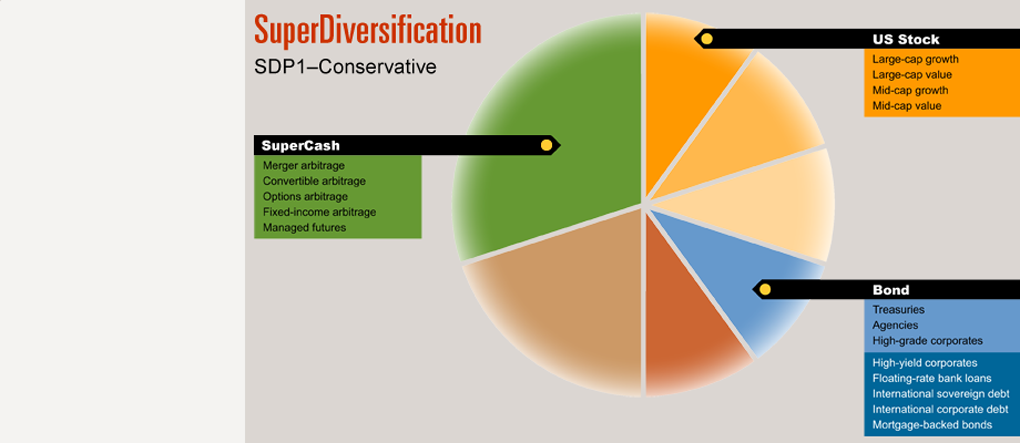

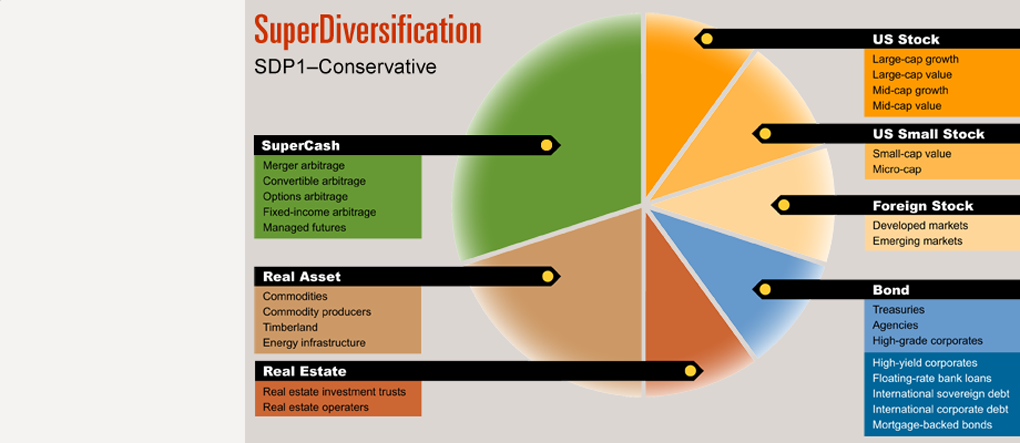

To the conventional asset mix, SuperD adds a set of asset classes and subclasses (SuperDiversifiers) which themselves have histories of solid performance, but tend to move out-of-sync with conventional assets, and with each other.

This out-of-sync movement, technically termed low correlation, makes the portfolio’s growth less volatile over time. Portfolio risk is reduced while return potential remains substantial.

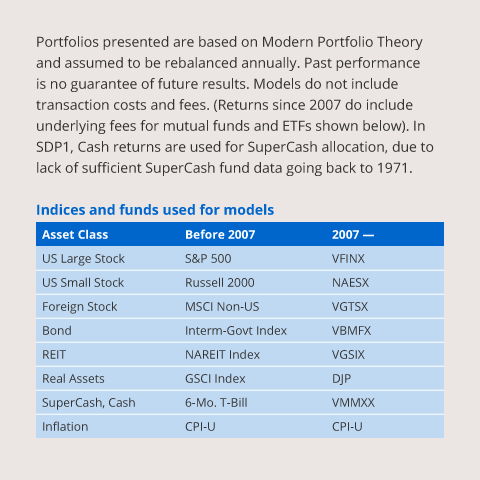

The SuperD portfolio is assembled entirely of mutual funds, closed-end funds (CEFs), and exchange-traded funds (ETFs), with a few strategic individual issues to complete the diversification.

Slides will play automatically. To pause, place cursor over graph area. To resume, click on buttons below graph.